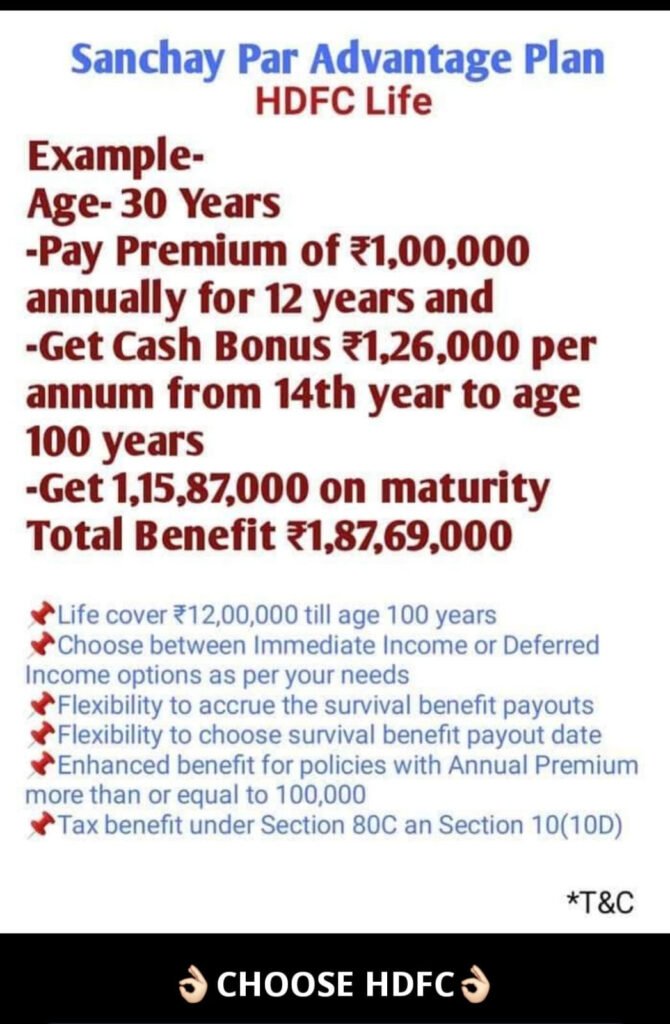

Sanchay Par Advantage: A Comprehensive Guide

HDFC Life Sanchay Par Advantage is a participating, non-linked life insurance plan designed to provide both financial security and regular income. It offers flexibility and customization to suit your specific needs and financial goals.

Key Features and Benefits:

- Life Cover: Provides lifelong life insurance coverage, ensuring financial protection for your loved ones in case of unforeseen events.

- Income Options:

- Immediate Income: Receive regular income payouts from the first policy year itself.

- Deferred Income: Receive guaranteed income after the premium payment term ends.

- Survival Benefits: Receive regular cash bonuses (if declared) throughout the policy term. These bonuses can be accumulated or received periodically.

- Flexibility: Choose between different premium payment terms and income payout options to suit your individual needs.

- Guaranteed Income: Enjoy guaranteed income payments after the premium payment term, providing financial stability in later years.

- Tax Benefits: Tax benefits may be available on premiums paid and certain benefits received under the policy (consult with a tax advisor for specific guidance).

Who is Sanchay Par Advantage suitable for?

- Individuals seeking both life insurance protection and regular income.

- Those planning for retirement or other long-term financial goals.

- Individuals who want to create a legacy for their loved ones.

Important Considerations:

- Policy Terms: Carefully review the policy terms and conditions before making a decision.

- Financial Needs Analysis: Consult with a financial advisor to determine the appropriate coverage amount and policy options.

- Risk Tolerance: Assess your risk tolerance and choose a plan that aligns with your financial goals and comfort level.

Disclaimer: This information is for general guidance only and does not constitute financial advice. Please consult with a qualified financial advisor for personalized recommendations and to understand the terms and conditions of the policy in detail.Note: This information is based on general understanding and may not be entirely comprehensive. Please refer to the official policy documents and consult with an HDFC Life representative for accurate and up-to-date information.